Life Insurance in and around S Charleston

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

It can be what keeps you going every day to provide for your partner, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can pay for college and/or maintain a current standard of living as they mourn your loss.

Insurance that helps life's moments move on

Now is a good time to think about Life insurance

State Farm Can Help You Rest Easy

And State Farm Agent Cameron Vance is ready to help design a policy to meet you specific needs, whether you want coverage for a specific time frame or coverage for a specific number of years. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

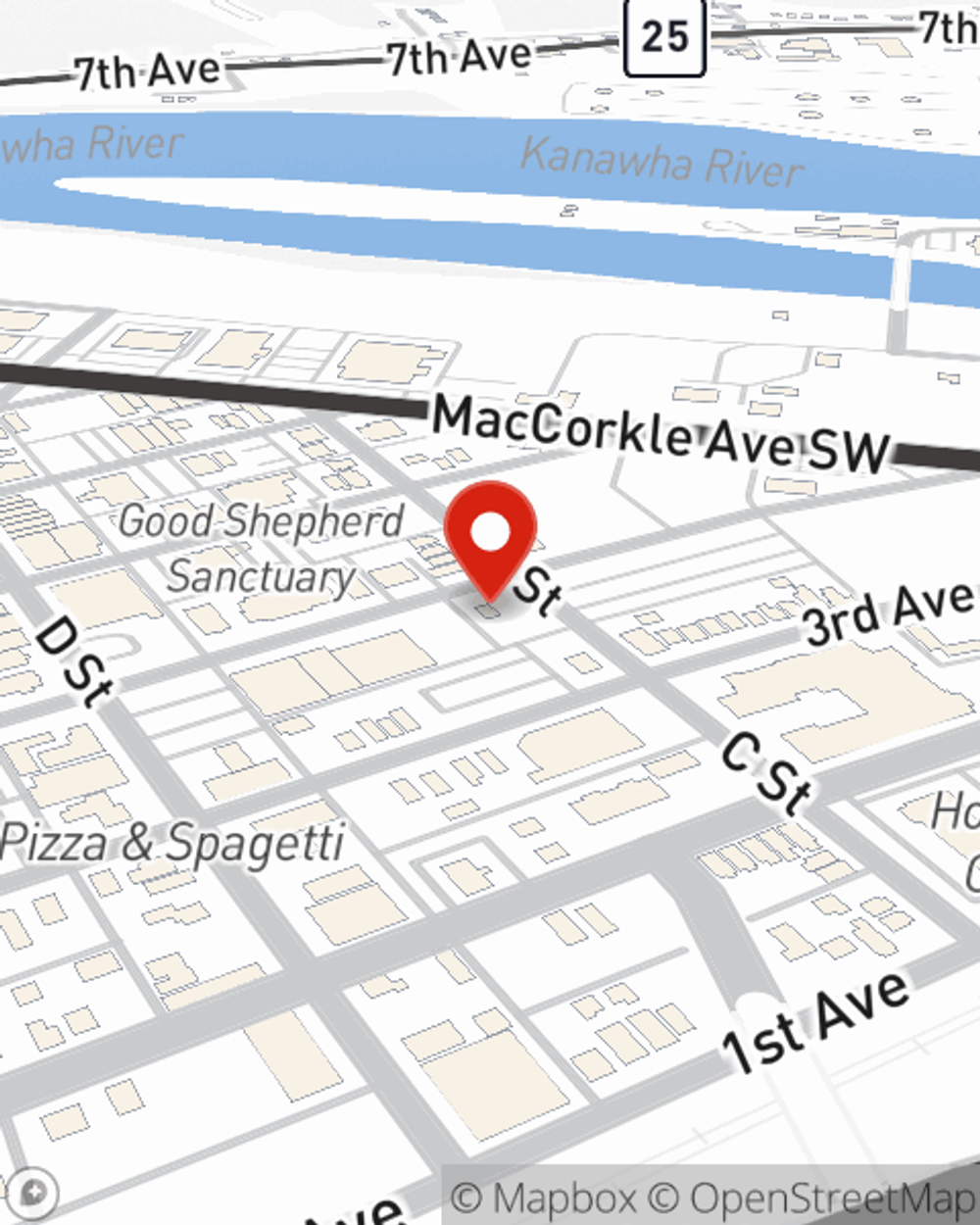

Simply visit State Farm agent Cameron Vance's office today to learn more about how a company that processes nearly forty thousand claims each day can help protect your loved ones.

Have More Questions About Life Insurance?

Call Cameron at (304) 744-4000 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Cameron Vance

State Farm® Insurance AgentSimple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.